Understanding Blockchain Easy Insights for Everyone

Blockchain Basics: A Simple Guide for Beginners

Demystifying the Jargon: Breaking Down Complexities

Alright, let’s dive into the world of blockchain without getting lost in a sea of jargon. Blockchain is essentially a digital ledger – think of it as a fancy online notebook that records transactions. It’s shared across a network of computers, making it transparent and resistant to tampering.

Understanding the Blocks: Simple Building Blocks of Blockchain

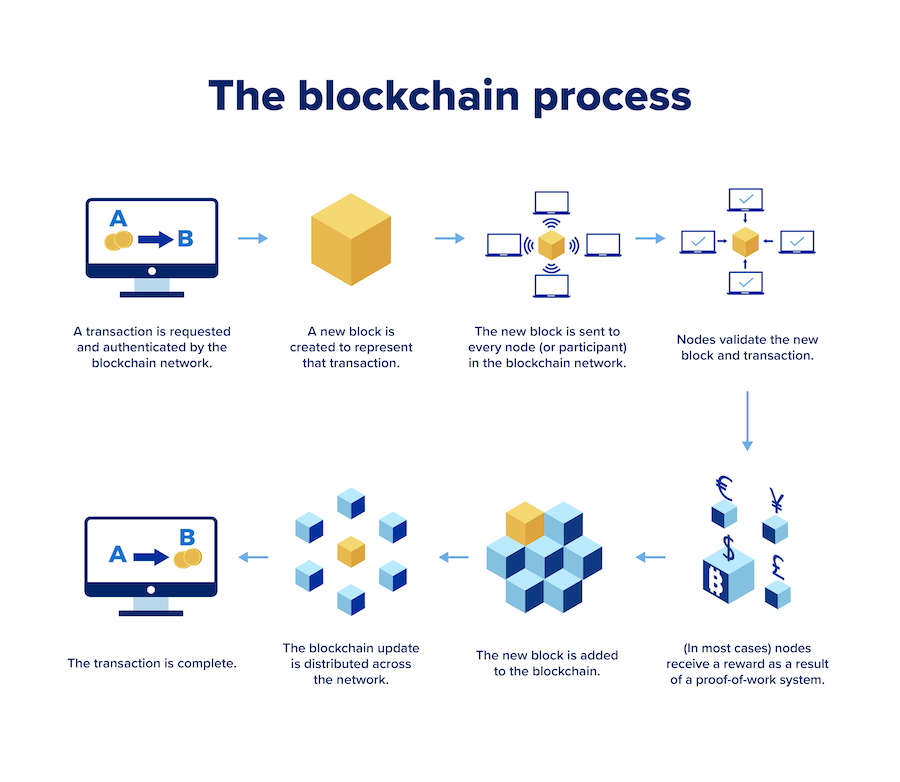

Now, let’s talk about those “blocks” in blockchain. Each block contains a list of transactions, and once it’s full, a new block is created and linked to the previous one, forming a chain. This chain of blocks ensures that the information is organized and, more importantly, secure.

Decoding the Decentralization: No Big Brother Watching

One of the cool things about blockchain is its decentralized nature. Unlike traditional systems with a central authority, blockchain operates on a peer-to-peer network. No big boss is keeping an eye on everything; instead, everyone on the network has a copy of the same information. It’s like a team effort in maintaining the records.

Securing Transactions: Fort Knox in the Digital World

Security is a big deal in the digital realm, and blockchain takes it seriously. Each block is encrypted and linked to the previous one with a unique code. This makes altering any information in a block practically impossible without changing the entire chain – an almost Herculean task.

Blockchain ABC: The Simplest Roadmap to Understanding

Let’s break it down in ABC terms. A is for “Anonymity.” In blockchain, transactions happen with a digital signature, not your personal details. B is for “Blocks,” the building blocks of the chain. C is for “Consensus,” meaning everyone on the network agrees on the transactions.

A Simple Dive: How Blockchain Works in Layman’s Terms

Now, let’s take a simple dive into how transactions work. When someone initiates a transaction, it’s broadcasted to the network. Miners (not the kind with pickaxes) then compete to solve a complex mathematical puzzle to validate the transaction. The first one to solve it gets to add the new block to the chain.

Easy Peasy Blockchain: Learning Made Simple

Don’t let the techy talk intimidate you. Blockchain is all about transparency, security, and a shared responsibility among its users. It’s like having a community-run bank where everyone keeps an eye on the books, making sure everything adds up without a single shady transaction.

Blockchain for Beginners: Starting the Learning Journey

If you’re a beginner, fear not. Learning about blockchain might seem like stepping into a new universe, but it’s a universe where transparency and security reign supreme. As you navigate the basics, you’ll realize it’s not as complicated as it sounds – it’s just a clever way of making digital transactions safer and more accountable.

Unraveling the Myths: Separating Fact from Fiction

Before we wrap things up, let’s bust a myth or two. Blockchain isn’t only about cryptocurrencies like Bitcoin; it has a much broader scope. It’s not as energy-consuming as some say, and no,