Unlocking Real Estate Blockchain’s Land Revolution

Unlocking the Future: Blockchain’s Impact on Land Ownership

In the ever-evolving landscape of real estate, blockchain technology is emerging as a transformative force, reshaping how we buy, sell, and manage land. Let’s delve into the profound influence of blockchain on land ownership, exploring its potential and the shifts it brings to the traditional real estate paradigm.

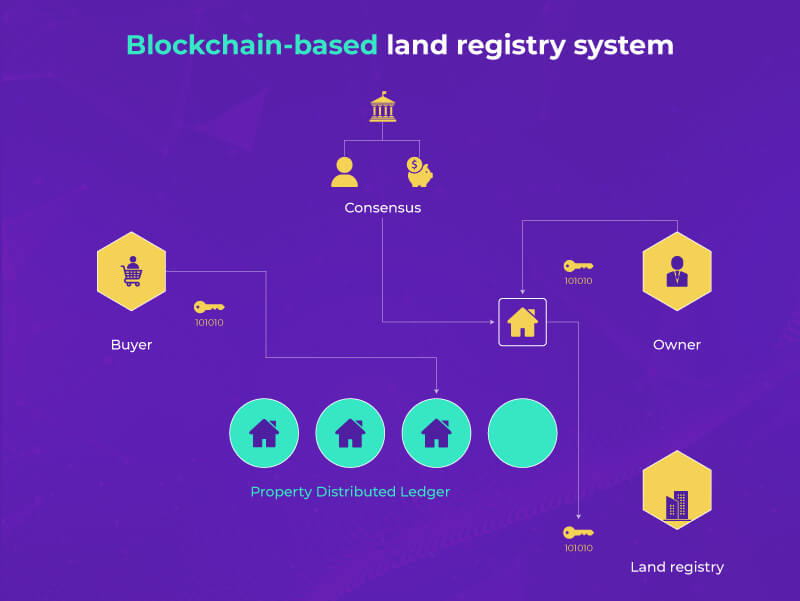

Revolutionizing Transactions with Digital Deeds

Traditional real estate transactions often involve a labyrinth of paperwork and intermediaries. Enter blockchain, the disruptor that is revolutionizing this landscape by introducing digital deeds. Blockchain’s decentralized and tamper-resistant ledger ensures that land ownership records are transparent, secure, and easily accessible. This innovation streamlines the buying and selling process, reducing the complexities associated with traditional transactions.

Land on the Blockchain: Pioneering Ownership

Blockchain brings the concept of ownership into the digital realm, pioneering a new era where land is represented as digital assets on a blockchain. This not only simplifies the transfer of ownership but also opens up possibilities for fractional ownership, making real estate investments more accessible to a broader range of individuals. The blockchain becomes a secure and immutable ledger, certifying ownership with unprecedented transparency.

Smart Transactions: Navigating Real Estate with Blockchain

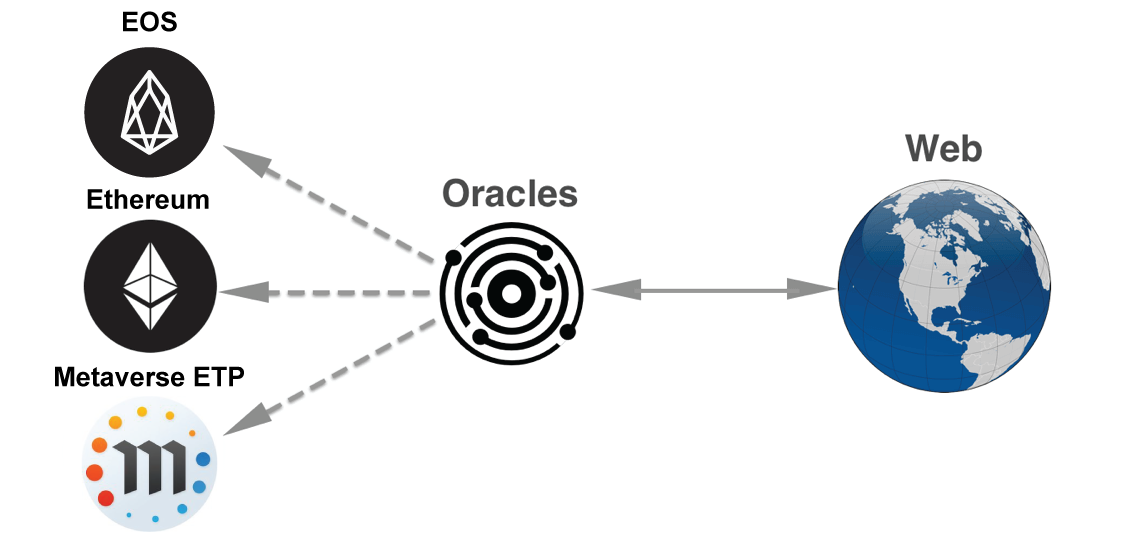

Smart contracts, a hallmark of blockchain technology, play a pivotal role in transforming real estate transactions. These self-executing contracts automatically enforce the terms of an agreement when predefined conditions are met. In the context of land ownership, smart contracts facilitate seamless transactions, eliminating the need for intermediaries and reducing the risk of fraud. Blockchain’s smart transactions redefine the efficiency and security standards in real estate dealings.

Decentralized Acres: Blockchain in Modern Land Rights

Blockchain introduces the concept of decentralized land rights, where ownership is not governed by a central authority but distributed across a network of nodes. This decentralization enhances the security of land rights, as the information is not stored in a single vulnerable location. Landowners can have greater confidence in the integrity of their property records, mitigating the risks associated with centralized land registries.

Virtual Plots: The Future of Blockchain Land Ownership

With blockchain, land ownership transcends physical boundaries and enters the digital realm. Virtual plots, represented as non-fungible tokens (NFTs), enable a new form of ownership where individuals can buy, sell, and trade digital representations of land. This concept is particularly gaining traction in virtual worlds and gaming, where players can acquire virtual real estate using blockchain technology, blurring the lines between the physical and digital worlds.

Crypto Plots: The Future of Blockchain Land Deals

The emergence of blockchain has given rise to the concept of crypto plots – digital land parcels bought and sold using cryptocurrencies. This innovative approach to real estate transactions not only leverages the efficiency of blockchain but also opens up new avenues for global real estate investment. Crypto plots represent a borderless and decentralized future where anyone, anywhere, can participate in land deals without the constraints of traditional banking systems.

Terra Bytes: Blockchain’s Evolution in Virtual Land

The evolution of blockchain in virtual land is measured in